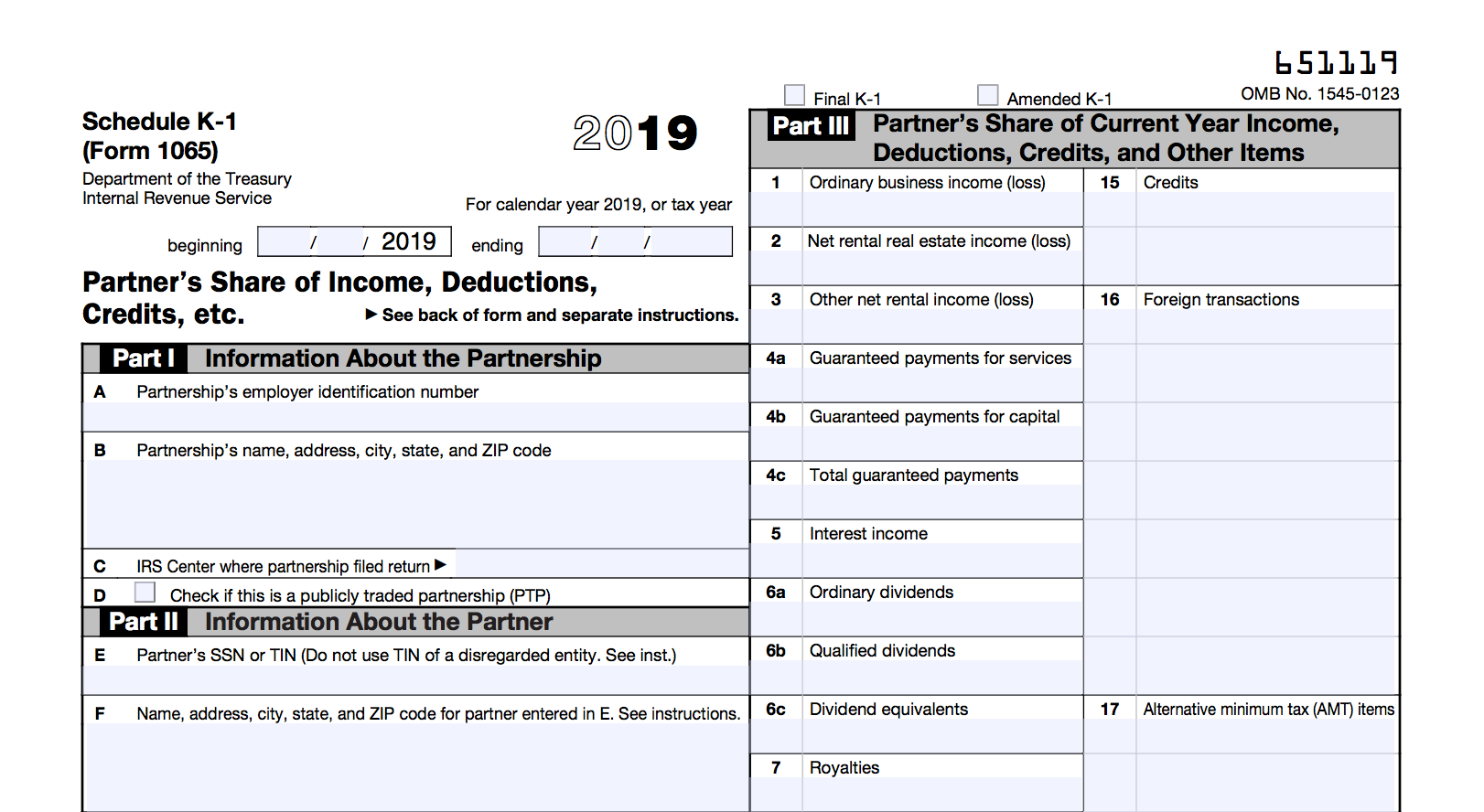

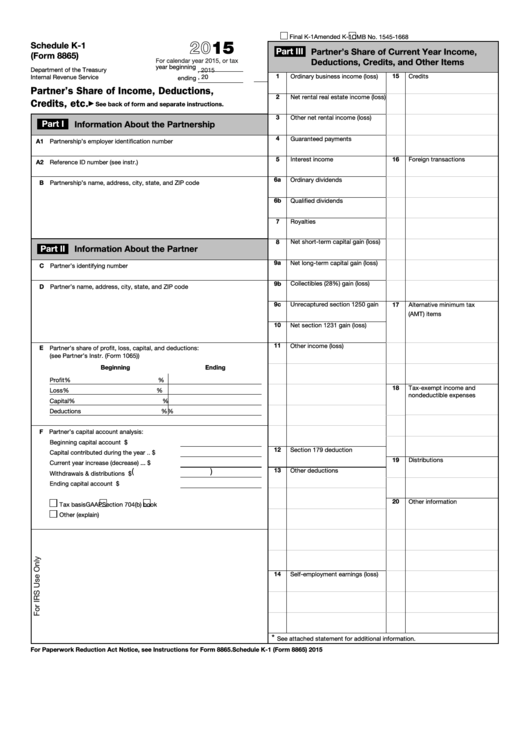

Interest allocable to production expendituresĬode T. Interest expense for corporate partnersĬode R. Recapture of section 179 deductionĬode N.

:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)

Dispositions of property with section 179 deductionsĬode M. Look-back interest - income forecast methodĬode L. Look-back interest - completed long-term contractsĬode K. Recapture of low-income housing creditĬode J. Qualified rehabilitation expenditures (other than rental real estate)Ĭodes F and G. Link to Form or Instructions from partner’s informationĬode D.

You can also review these Partnership Instructions. Please click here for instructions regarding the other codes for Box 20 that our program does not support. All other codes for box 20 are not supported. Box 20A and 20B are supported in the program through K-1 entry.īelow is information for Box 20W and how to report within the program. Items reported on your Schedule K-1 (Form 1065), box 20 may need to be entered directly into a specific form instead of through the K-1 entry screen.

0 kommentar(er)

0 kommentar(er)